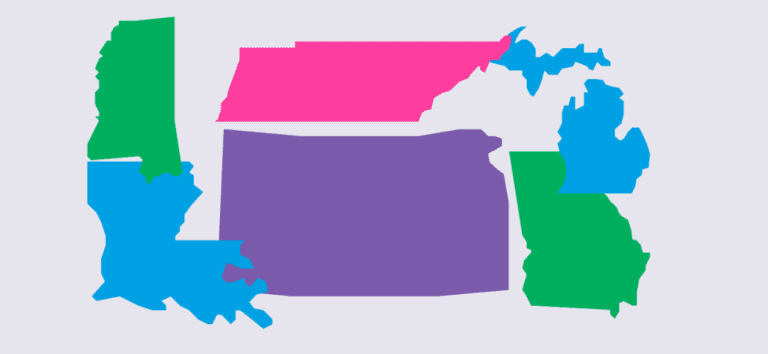

Recently we reported that Florida joined most other states that charge sales tax and passed a Marketplace Facilitator Law. Marketplace Facilitator laws shift the responsibility from Marketplace Sellers (Event Organizers) to Marketplace Facilitators like GiveSignup | RunSignup to collect and remit sales tax on behalf of Marketplace sellers. While researching the change in the Florida law we discovered that several other states including Georgia, Kansas, Louisiana, Michigan, Mississippi and Tennessee have also passed marketplace facilitator laws since we implemented our sales tax system over a year ago.

Our research indicates that merchandise sold on the GiveSignup | RunSignup site for all states and race registrations in some of the states (KS, LA, MS) are subject to sales tax with a few exceptions. Fortunately GiveSignup | RunSignup is ready to handle this responsibility on your behalf and also offers options that allow you to claim any exemptions that you are entitled to.

GiveSignup | RunSignup will begin collecting and remitting sales tax on your behalf effective on July 31st for Kansas. For the rest of the states (GA, LA, MI, MS & TN) we will begin collecting and remitting on August 1st. If you are eligible for an exemption you will need to update your race to claim the exemption by following these steps (we are not permitted to do this for you):

On the Race Dashboard navigate to Financial >> Sales Tax >> Sales Tax Setup.

Nonprofits may have additional exemptions they may qualify for based on the type of nonprofit organization. Choose the Exemption Reason and enable the exemption if applicable.

At the bottom of the page it will ask for your signature and to confirm you have the authority to make such certifications on behalf of the organization.

Don’t forget to review the taxable items by going to Financial >> Sales Tax >> Taxable Items in order to properly categorize any items that may be for sale so appropriate tax is collected as well.

Note that participants will be responsible for paying the sales tax. If you are eligible for an exclusion and do not make this election, we are not able to recover money from the state to process refunds to participants without refunding the entire transaction