The RunSignup Sales Tax System

Our modern sales tax system helps you meet the complex challenges of complying with the law. Collecting sales tax and preventing sales tax liability is an important part of event ownership. RunSignup’s sales tax system is composed of three key components:

Sales tax calculation and collection based on the complex tax laws of over 9,000 sales tax jurisdictions in the United States.

For Marketplace States, RunSignup is responsible for calculating, collecting, reporting, and remitting sales tax to each Marketplace state. We do this automatically and provide easy mechanisms to set up sales tax details and to support nonprofit seller exemptions in the states where they exist.

For Non-Marketplace states, we make our sales tax system available to events as an option. If you turn on sales tax for your race, we will calculate and charge the sales tax and remit the sales tax proceeds to you. We will also provide reports of what sales have been taxed and the sales tax collected for your race for you to be able to file your sales tax returns with the appropriate state(s).

We have lots of documentation

Love the details? We have a variety of resources to help you with our understanding of the state sales tax implications for selling registrations and related items on our site for your organization including:

RunSignup Taxability Matrix – Shows which states are Marketplace or non-Marketplace, as well as our understanding of the taxability for race fees, add-on items, memberships, ticket events and nonprofit seller exemption availability by state.

RunSignup Sales Tax Policies – This reviews the background on sales tax, our obligations and event obligations.

Marketplace State Collection and Reporting – This reviews how RunSignup complies with the marketplace laws in those states (38 and growing) by filing one consolidated sales tax return for all of our customers within a given marketplace state. This unburdens event organizers from the tedious details of sales tax compliance and reporting for their race.

Marketplace Setup – This reviews how nonprofits and others can set up their seller’s exemption in states where they exist, as well as set up and specify taxable items.

Non-Marketplace State Collection and Reporting – This reviews how RunSignup helps events in non-marketplace states by collecting and remitting sales tax funds directly to your organization. We also provide informational reporting to help you file your sales tax returns in your state(s).

Non-Marketplace Setup – This reviews how nonprofits and others can set up their seller’s exemptions in states where they exist as well as specify taxable items.

Detailed Sales Tax Implementation – This digs into the deep technical implementation of our Sales Tax system.

Sales Tax Release Q&A – We had dozens of questions on our Sales Tax Webinar, and we know that there will be many more to come. To help, we have compiled answers to all of the questions here.

Sales Tax FAQ for Event Organizers

Sales Tax FAQ for Participants

Have questions? Contact info@runsignup.com

All the Latest Blogs on Sales Tax

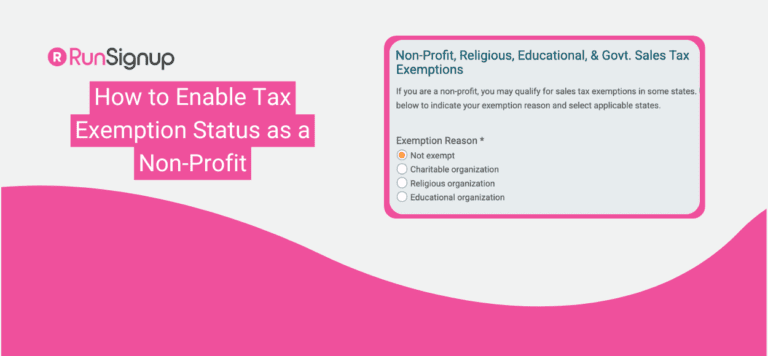

How to Enable Tax Exemption Status as a Non-Profit

In many states, there are exemptions available for charging sales tax on your race registration or merchandise sales. These are most often available to non-profits or government entities. If your non-profit is eligible to claim an exemption from sales tax on selling…

Read MoreChange in Wisconsin Sales Tax for Non-Profits

Recently we heard from the Wisconsin Department of Revenue that it was not appropriate for RunSignup to allow an exemption from sales tax for nonprofit organizations (including government entities). They provided a Wisconsin Department of Revenue Marketplace Provider Common Questions guide. Item…

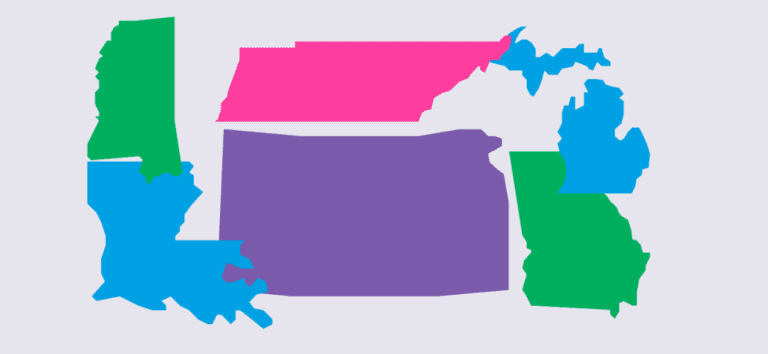

Read MoreGA, KS, LA, MI, MS, TN Pass Marketplace Facilitator Sales Tax Laws: Action Required for Nonprofits

Recently we reported that Florida joined most other states that charge sales tax and passed a Marketplace Facilitator Law. Marketplace Facilitator laws shift the responsibility from Marketplace Sellers (Event Organizers) to Marketplace Facilitators like GiveSignup | RunSignup to collect and remit sales tax on behalf of Marketplace…

Read MoreFlorida Passes Marketplace Facilitator Sales Tax Law: Action Required for Nonprofits and Events Charging for Spectators

IMPORTANT: Action Required for Nonprofits and for Events Charging for Spectators Recently Florida joined most other states that charge sales tax and passed a Marketplace Facilitator Law. Marketplace Facilitator laws shift the responsibility from Marketplace Sellers (Event Organizers) to Marketplace Facilitators like GiveSignup | RunSignup…

Read MoreChicago Amusement Sales Tax

Chicago has a sales tax on amusements which includes events. However, there are two exemptions available:501C3 organizations Events that comply with all 5 of these criteria: – 501C3 Organizations OR – Events that meet all 5 of these criteria: The good news…

Read MoreSales Tax Update for Wyoming

The power of our community has benefited our Sales Tax implementation again. Since beginning this project, we have had help from dozens of our customers who have helped provide clarification to how their local sales tax laws apply to races and nonprofits….

Read MoreSales Tax January Top Payments

We are nearing routine mode for Sales Tax since widely releasing it on December 1, 2019. Of course the purpose is to comply with state a local sales tax laws, and to make things simpler and more accurate for our customers. We are in…

Read MoreOur 2020 Winter Symposium is over, but there’s still time to catch up. You can view the slides from presentations anytime, and now the video recordings of our sessions are starting to pop up. Next up: Sales Tax and Your Race With Kevin Harris Kevin Harris,…

Read MoreRunSignup Sales Tax in all 50 States

We are rolling out sales tax collection for the final state – Colorado – today. We had rolled out the other 49 states and the District of Columbia a couple of weeks ago. Colorado posed a bit of a challenge, with their structure as…

Read MoreSales Tax Stats – Early Feedback

We are trying to gather early feedback since we fully released the sales tax system on December 2. Some interesting stats so far – some are too early to see any real trends, but some are substantial enough to have some meaning….

Read MoreEnabling Nonprofit Exemptions

As we pointed out in a previous blog post, and in our Sales Tax Policies and Instructions, nonprofits must explicitly specify their exemption status. This is to ensure that nonprofit organizations are complying with state laws. The reason for this reminder is that we…

Read MoreSales Tax Liability – $10 Million annually

There is a lot of confusion about why RunSignup has built a major sales tax system for our customers, or why RunSignup is collecting sales tax on behalf of our customers in the growing number of states with marketplace laws. The answer is simple…

Read More