April 2023 Update: This insurance option is now live! We shut down Allianz insurance sales on Friday March 31 and turned on Protecht insurance on Monday, April 3. For any events that had insurance turned on, there were no sales over the weekend. Starting around mid day Eastern on Monday April 3, all Allianz customers were automatically switched to Protecht and their insurance was be turned on.

For more details, you can view a webinar with the RunSignup and the Protecht Regshield teams here.

Starting in April we will be switching registration protection insurance providers from Allianz (first released in 2016, they have been a good partner) to Protecht’s FanShield-RegShield product. Registration protection insurance gives participants an opportunity to purchase insurance in case they are unable to attend an event for any number of covered reasons. The Protecht offering is fairly similar to what we provide today, with the added benefit that the minimum premium is lower and therefore applicable to a wider range of events. As with the previous product, events that offer registration protection insurance will be able to earn a 20% revenue share from RunSignup on the sales of registration insurance for their event.

Customer Service

For many events offering an insurance option simplifies customer service. If someone is unable to attend an event for a covered reason and purchased insurance the insurance provider handles all of the refunds, and there is no extra work for the event to make a refund. Needless to say, it also minimizes refunds and lost revenue the race might have to face to provide high levels of customer satisfaction.

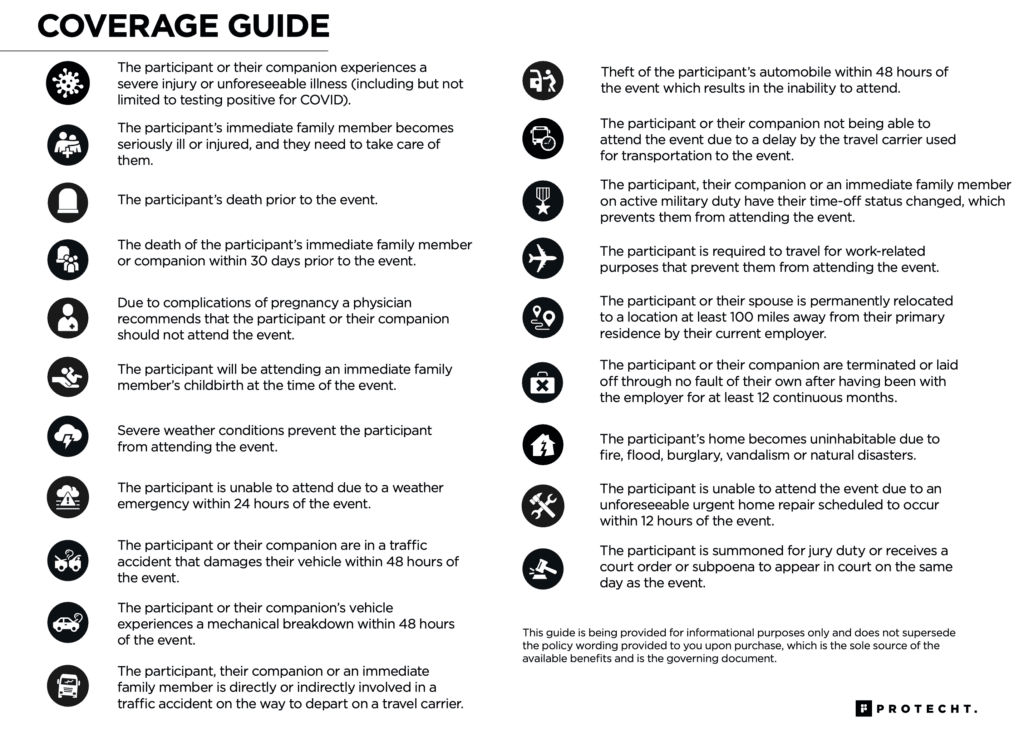

Also, having insurance can provide peace of mind to participants who register early and worry about injuries or family emergencies not enabling them to join the event. The list of items covered include:

- Accident and Illness

- Travel Interruptions

- Family Emergencies

- Layoffs

- Jury Duty

- Work Travel Conflict

Pricing

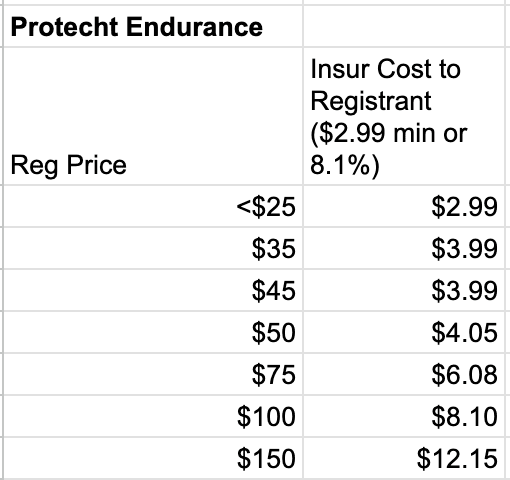

The price of the Protecht RegShield registration insurance is calculated on the registration amount plus processing fees. It does not include add-ons, sales tax or donations. The pricing is minimum charge of $2.99 for transactions up to $24.99, $3.99 for transactions between $25.00 – $49.23, and 8.1% above that (Allianz was a $6.99 minimum).

Revenue Share

RunSignup has worked on a program with Protecht RegShield where we earn a lead generation fee for events that offer the insurance and we share a part of the fee with the event. The part the event earns is equal to 20% of the insurance premiums generated by participants that purchase insurance for the event. At the minimum premium, this represents $0.60 per participant. Payments are made after the event has completed.

As an example, there is a marathon that uses the existing insurance and charges race registration fees in the $80-110 range. For their race 11% of participants choose to buy the insurance. For events that offer insurance we have seen participation rates as high as 10-20%.

In addition to the customer service benefits, this is a nice revenue generation source for your event.

What the Customer Sees

The participant will see a checkout page that is similar to how it looks today, with an option to purchase insurance or not purchase insurance:

The customer will see two transactions on their credit card – one from RunSignup and one from Protecht RegShield – in the above case for $11.58 and $2.99.

The customer will receive two confirmation emails – one from RunSignup for the registration and the other from RegShield with instructions for filing claims and the details of what is covered.

Note that the RegShield transaction is delayed 30 minutes so that the standard cancel transaction functionality on RunSignup of 15 minutes is passed. This means the email will go out about 30 minutes after the RunSignup transaction completes.

Dashboard Setup and Reporting

Setup is very simple:

Similar to the current insurance offering, there will be a report to show each purchase covered by insurance.

Protecht RegShield – Participant Communications

This is a sample of the email:

Insurance Coverage FAQ

Protecht has a FanShield-RegShield list of Frequently Asked Questions that can be a useful link to provide from your event website. This link to more information on coverage.

Here is a quick summary of the coverage offered to participants:

Note: The weather one is if severe weather prevents the participant from getting to the event/race, it does not include if the race is cancelled.

Migration from Allianz to Protecht RegShield

We will be converting customers over to the new insurance product in April and will release more details before the final cutover.