RunSignup is a full payment solution – meaning we take care of all the hassles of credit card merchant account management. This means that there is no more messy reconciliation of a registration platform and a Stripe account and we pay customers efficiently as they sell registrations and tickets (and don’t hold the money until after the event). It also means we manage the chargeback process for all of our customers.

Last year our customers sold over 10 Million registrations and tickets. There were 2,400 chargebacks that resulted from those transactions. Our finance team handles all of the chargebacks on behalf of customers because we have an efficient process and experience in understanding what will and will not be successful. We have built up a set of policies and tools based on that experience that help us maximize fair settlements.

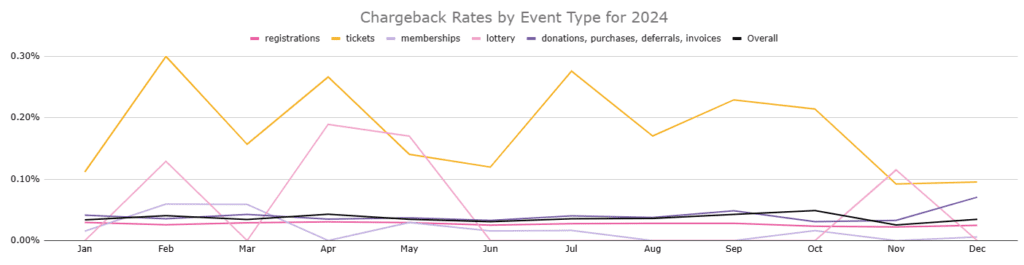

The data and charts presented below are all chargebacks that took place in 2024.

This first chart is the rate on a monthly basis by event type – – about 0.2 – 0.3% for tickets and less than 0.1% for our RunSignup registration, donation and membership transactions.

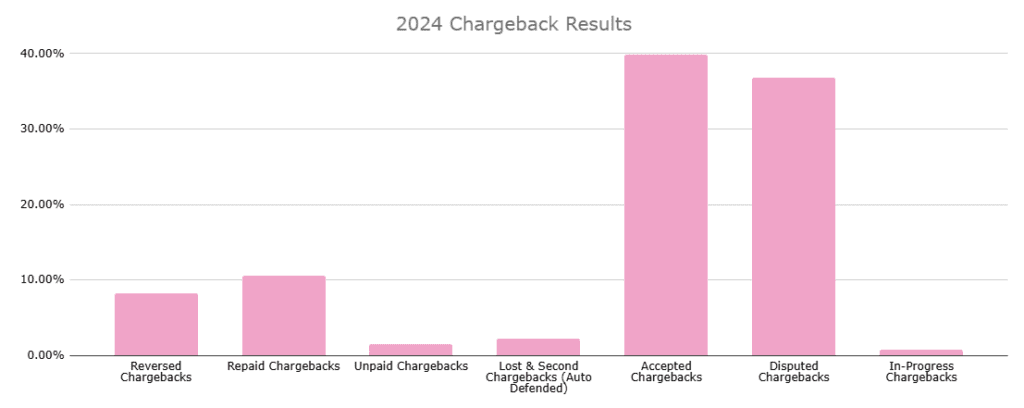

Of all chargebacks, events either accept or we win over 75% of all chargebacks.

There are several major categories of chargebacks:

- Acceptance by the Event – 40% – we work with the event to decide if the chargeback should just be accepted since there was a legitimate reason. For example, a card holder processes a chargeback because they could not find water or lines were long (not at checkin!) and the event decided not to fight those and risk further alienating this ticket buyer.

- Disputed – 37% – this is where RunSignup decides it is worth trying to dispute the chargeback after trying to contact the customer. As you will see below, we win about half of these for events.

- Reversed Chargebacks – 8% – this is where the card holder reverses the chargeback after we reach out directly to the cardholder. This is a win for the event.

- Repaid Chargeback – 11% – this is where the card holder pays the event back by various means. Sometimes we send them an invoice, sometimes they make another donation or buy another ticket. This is also a win for the event.

- Lost and Second Chargebacks – 3% – These are corner cases of the chargeback realm like a customer saying the charge is recurring when it is not. These are losses.

- Unpaid Chargebacks & In-Progress Chargebacks – 3% – These are waiting for the customer to pay, which is mostly just in process since we took a snapshot in time.

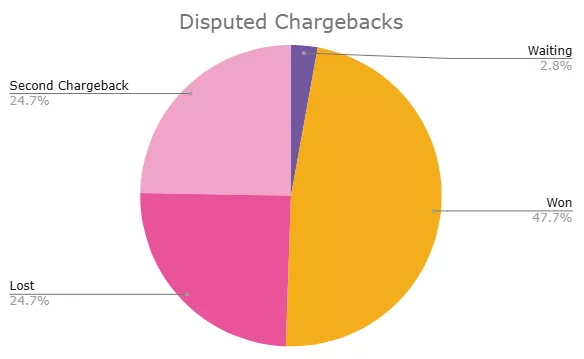

Dispute Win Rate

We have built up expertise and some automation and proof points to help win chargeback disputes. We automatically include proof of a “no refund” policy, the the fact that the person checked into the event (another reason to use our checkin app!), and signed waiver, etc. Customers who have moved to RunSignup find we win a much higher percentage of disputes than they have in the past.

- Dispute Win – this is where we process a dispute to the chargeback and it is accepted and our customer is able to receive the money (less the $7.50 that the credit card network charges us for every chargeback).

- Dispute Lost – this is where we receive quick notification from the payment processor that we have lost.

- Second Chargeback – this is where the processor might have sided with us, but the card holder complains to their card brand and the card brand sides with the card holder and the chargeback is enforced.

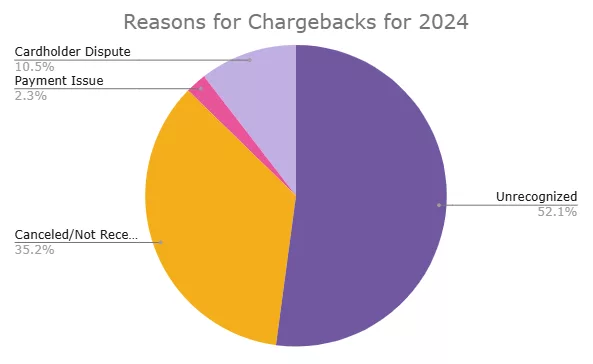

Reasons why Cardholders Dispute Charges

There are various reasons why card holders process and chargeback. We accept or win over 75% of these for our event directors.

Out of the over 10 Million registrations and tickets sold in 2024 on our platform, there were less than 1,300 categorized as unrecognized (and we win many of these since we can provide proof of purchase and delivery (especially with the checkin app). Many of those are also donations where the credit card statement might say XYZ Festival or ABC Marathon, but there was a donation to a charity.

The other big category is Cancelled or Not Received. Again, this can be solved with proof of attendance, but it still sometimes lost if the card holder was not satisfied with the event.

Summary

RunSignup has a very low chargeback rate overall because of the high quality KYC (Know Your Customer) standards we have on accepting customers (part of the sometimes tedious onboarding process of setting up a payment account). We have also built up a high quality reputation in communicating with the credit card processors and brands in disputing chargebacks. This results in high payment rates and ease of doing business for our event customers.

Finally, special thanks to our finance team, and especially Carolyn Beck who manages our chargeback process and provided all of these beautiful charts!