We track Eventbrite closely. They are the “Big Dogs” of event technology, so maybe we can learn something. More importantly, it helps us benchmark how we are doing in comparison. Eventbrite’s decline has been one of the sources of our growth as customers move from Eventbrite to TicketSignup for better technology, lower prices, and a cooperative vendor that offers real support.

We are Slowly Catching Up

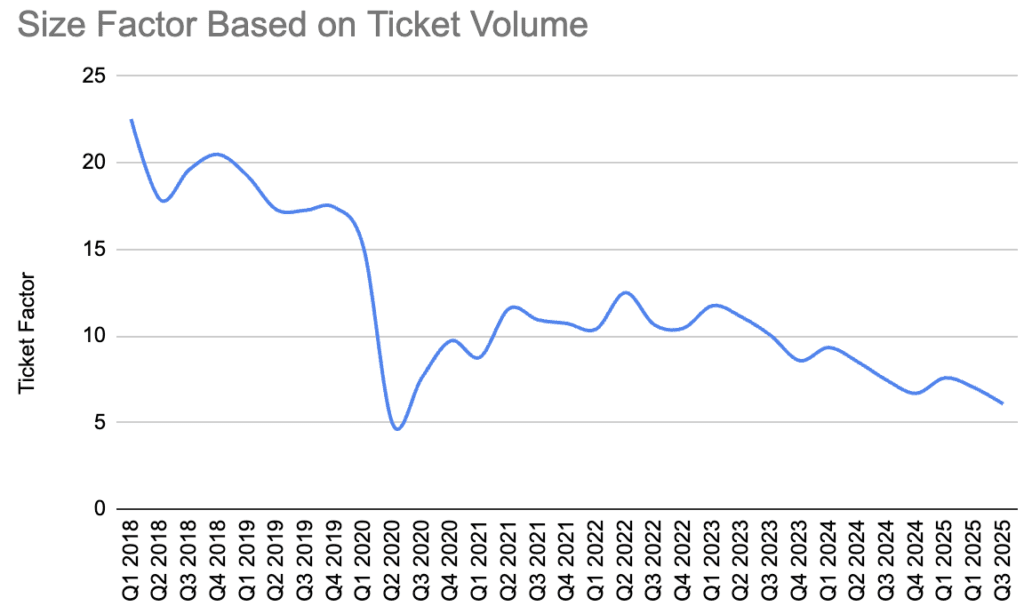

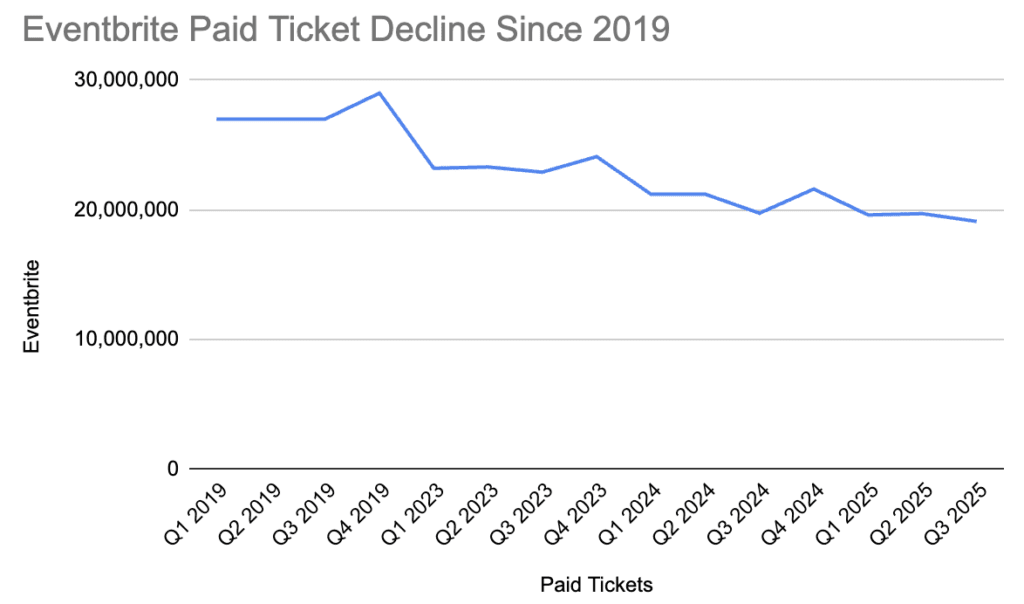

As Eventbrite continues to decline (tickets sold is down 29% vs. pre-pandemic while ours are more than double), we are slowly catching up to them. They are now only 6.1 times larger than us in terms of ticket sold vs. 15-20X our size in 2019).

Let’s dig into their Quarterly Report and Earnings call.

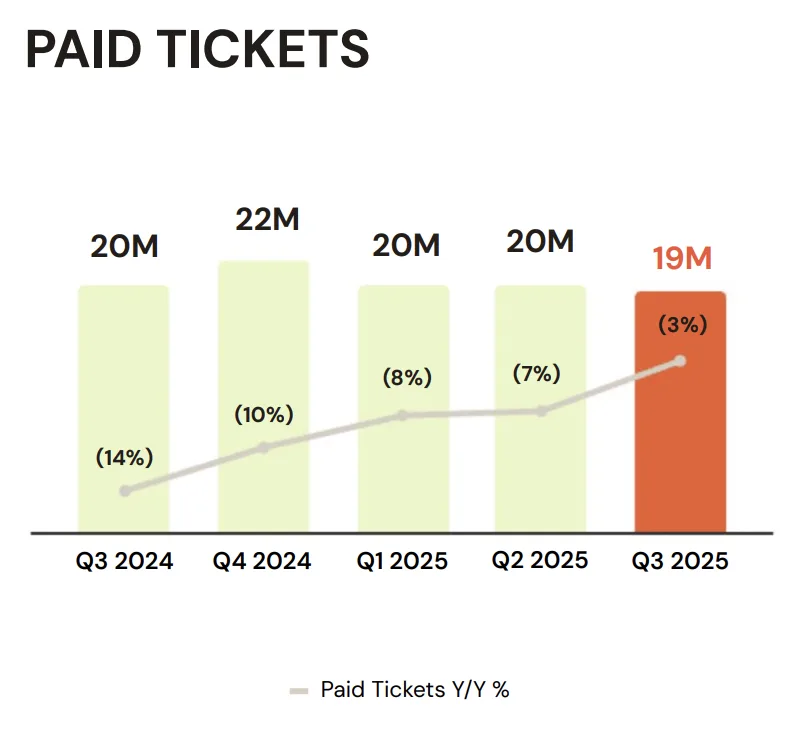

Slowing Decline in Ticket Volume

One of the themes of the quarter is that they are losing fewer customers and the decline in tickets sold is slowing. Paid tickets are down (bar graph), but the pace of decline is slowing (line graph).

Ad Revenue Increasing, But Subscription Revenue Falls

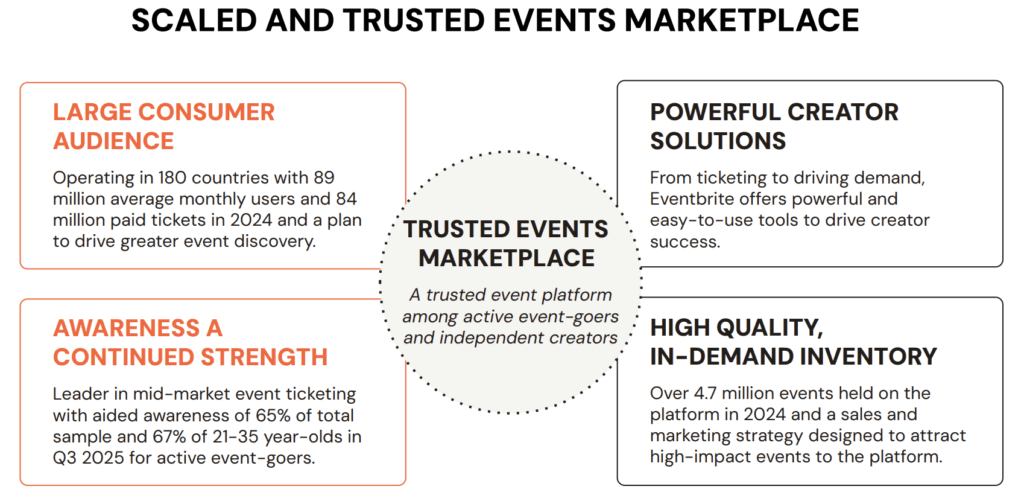

Last Q3, they still had subscription revenue. They have reduced this, so that revenue stream has decreased. However, their Ad Revenue increased 38%.

This is one of the areas where we have a fundamental difference in our business – Eventbrite believes they are a Marketplace and we believe we create technology that puts the customer’s brand first. Eventbrite places ads on event pages – many times for competitive events. This is especially true for events that pay Eventbrite for ads. We think this is a very bad strategy that hurts event customers. We feel events should have full website capability, and that it should be branded as their website. Eventbrite is a small part of the event discovery universe – Google, Meta, ChatGPT and friend referrals are all much larger. Events listing on Eventbrite need to incur ad costs to stay even when they list on Eventbrite. We saw the same behavior in the endurance marketplace and it is why so many of those vendors declined over the years – events want their own brand and they want respect from their event technology vendor.

Of course Wall Street loves the high margin business of ads. But it is a long term mistake. Helping customers be successful, not maximizing revenue from each customer our approach.

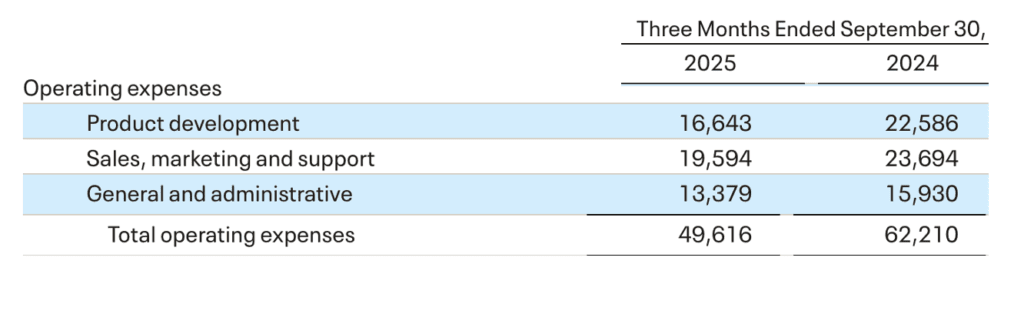

Cost Cutting

Eventbrite stock is up today because of the large reduction in expenses that drove the first real positive net income in company history. Unfortunately this came at the expense of many “Britelings” exits, and offshoring/outsourcing many functions including software development.

Expenses fell 36%, however 2024 had a $5.4 M restructuring charge (for reducing headcount).

Of course the question will be whether the smaller teams, with less experience, will be able to serve customers well with product and service. The stories we are hearing from customers who are moving is that they are not.

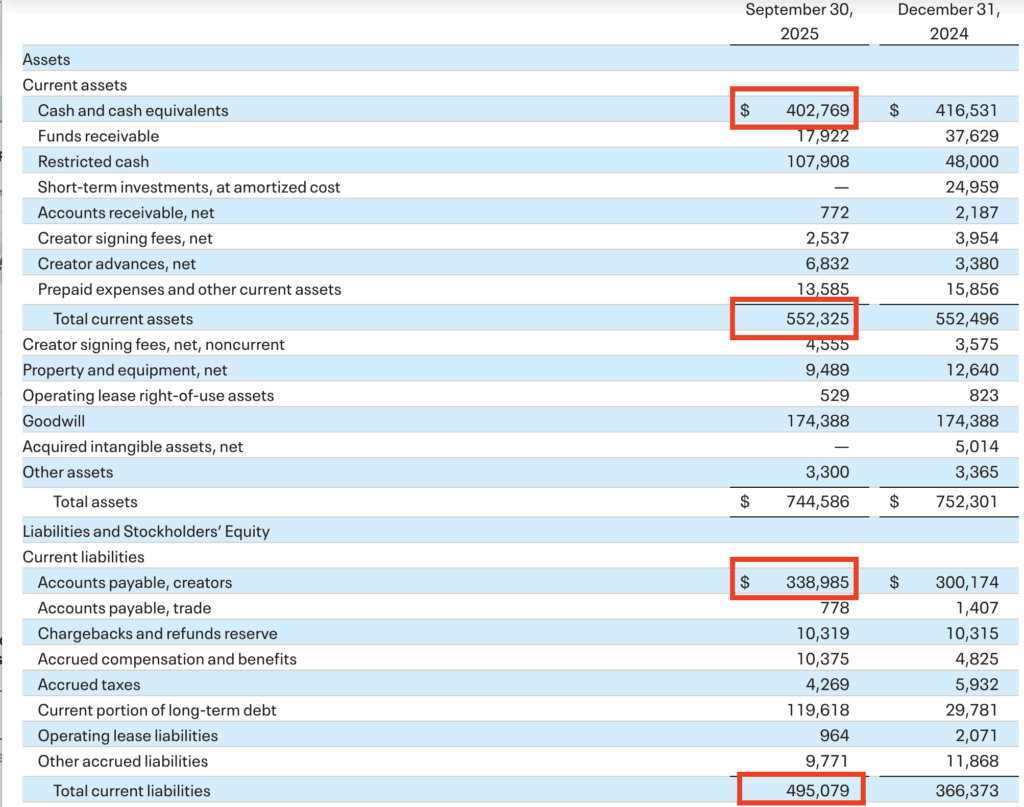

Customer Float

Eventbrite’s balance sheet shows that one of the ways they operate is to hold customer funds – $338 Million. This really helps hold the company together as it represents 84% of the cash and cash equivalents. This compares with RunSignup float being only 20% since we pay out daily or weekly to customers.

RunSignup Current Ratio (Current Assets / Current Liabilities) is 1.95 vs. Eventbrite’s is 1.11. Here is a blog about why current ratio is important.

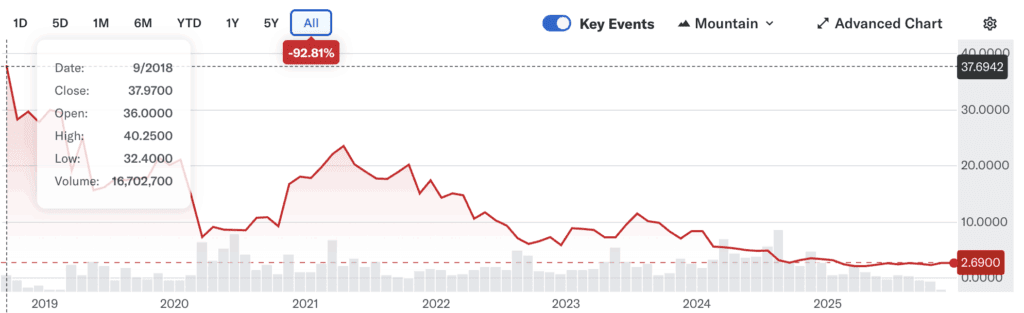

Long Term Trends

The long term trend of Eventbrite stock has been dismal. The company has a valuation of about $250 Million compared with over $3 Billion when they went public. Julia has been on a podcast tour working hard to convince the market of the company’s success (link, link, link, link, link, link).

Paid ticket sales have been in decline.

Summary

This quarterly benchmark continues to be positive for us. We are doing well in comparison with the “Big Dog”. And we have a compelling offering for customers open to looking at other platforms – so we should continue to grow.