Eventbrite entered a definitive agreement to be acquired by Bending Spoons for about $500 Million, or $4.50 per share. This is obviously a big decrease from when they went public in 2018 at $37 a share and a loss of $Billions in valuation. It is even lower than the pandemic low of $5.83. Not a successful run as we have recounted in our quarterly earnings reports, including Q3.

Eventbrite has struggled to get revenue and ticket sales back to what they were pre pandemic due to a number of issues we have reported on like high pricing, continual layoffs, offshoring and outsourcing of jobs, erratic policies on pricing, and not continuing to improve the value of their platform. They also made a strategic bad bet that they were a marketplace, which helped generate some incremental revenue, but hurt their customer and product focus.

Who is Bending Spoons?

They are a different type of private equity company. They have taken $4.9 Billion of capital investment from tier 1 investors like Fidelity, T Rowe Price, Goldman, JP Morgan, etc. They have rolled up a number of companies like AOL, Vimeo, Evernote, Meetup, etc. As Techcrunch explained:

“Bending Spoons is anything but a passive owner, making changes to the products’ user experience and features but also to the underlying tech; monetization strategy, including pricing; and team organization, including headcount.”

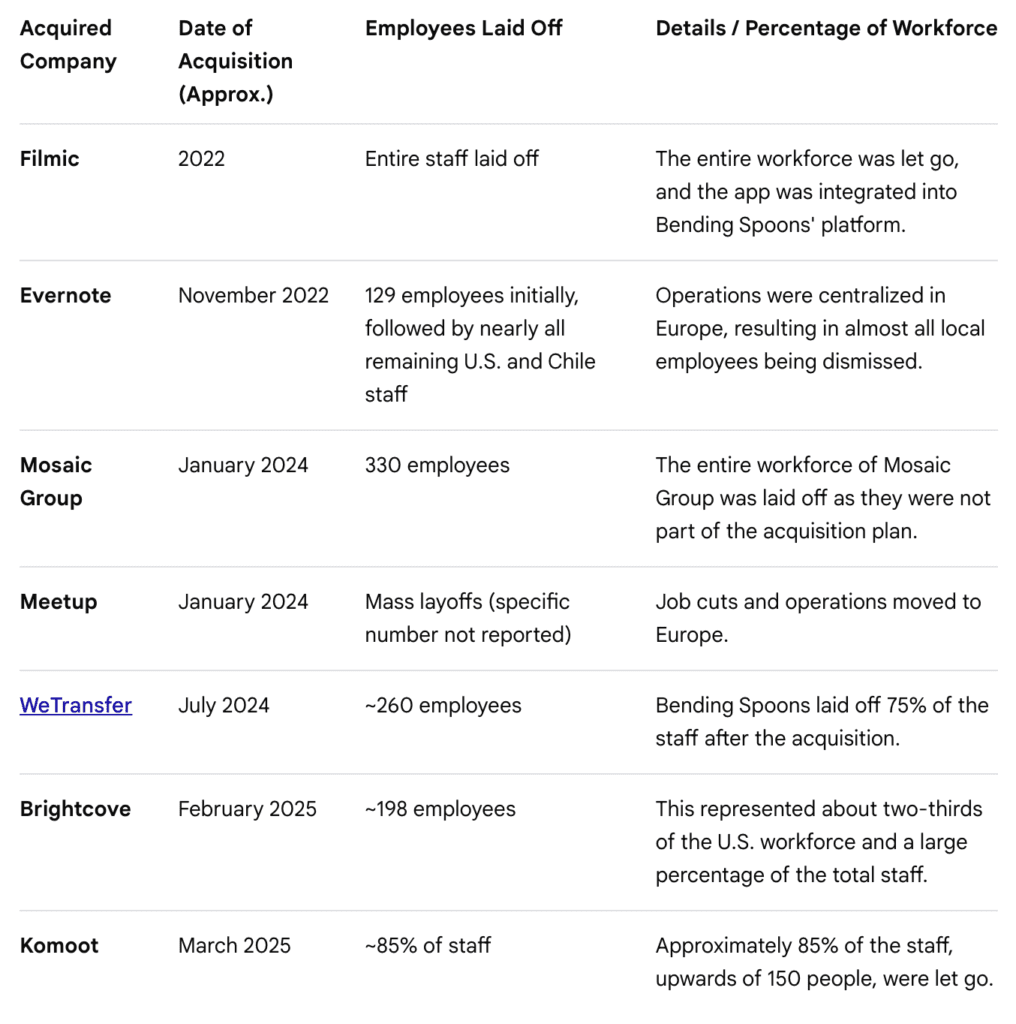

Google Gemini created these helpful charts to see some of the past companies and impact on headcount:

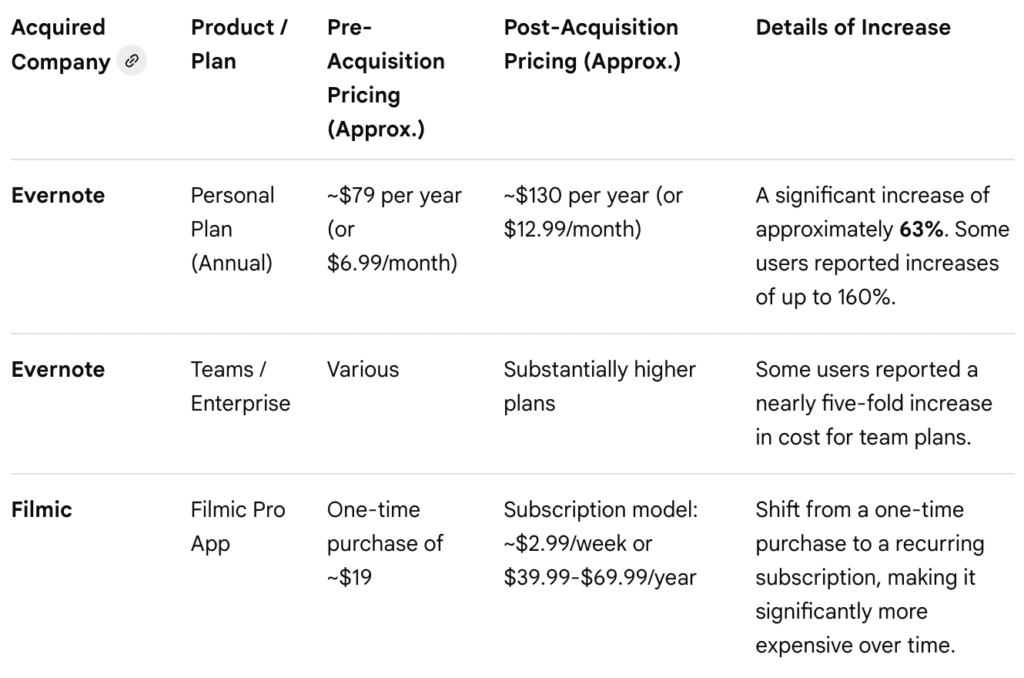

And what happens to pricing:

What does this mean for Eventbrite Customers?

It will likely take several months for this deal to close, so there will not be a lot of changes in the near term. It is likely that high quality talent might start leaving the company, although there are typically some golden handcuffs to keep key people from leaving.

Once the deal is complete, we would expect Bending Spoons to follow a similar path as they have in the past to earn a return on their $500 Million in cash: Cut costs – which means headcount and raise prices. There might also be an attempt at a tech mashup between Meetup and Eventbrite to reduce duplicative costs.

What that likely means for Eventbrite customers is an increase in prices and likely poorer quality of service and a stagnation in the technology as it is always hard for new people to take the place of existing talent and experience.

What does this mean for RunSignup?

A number of thoughts:

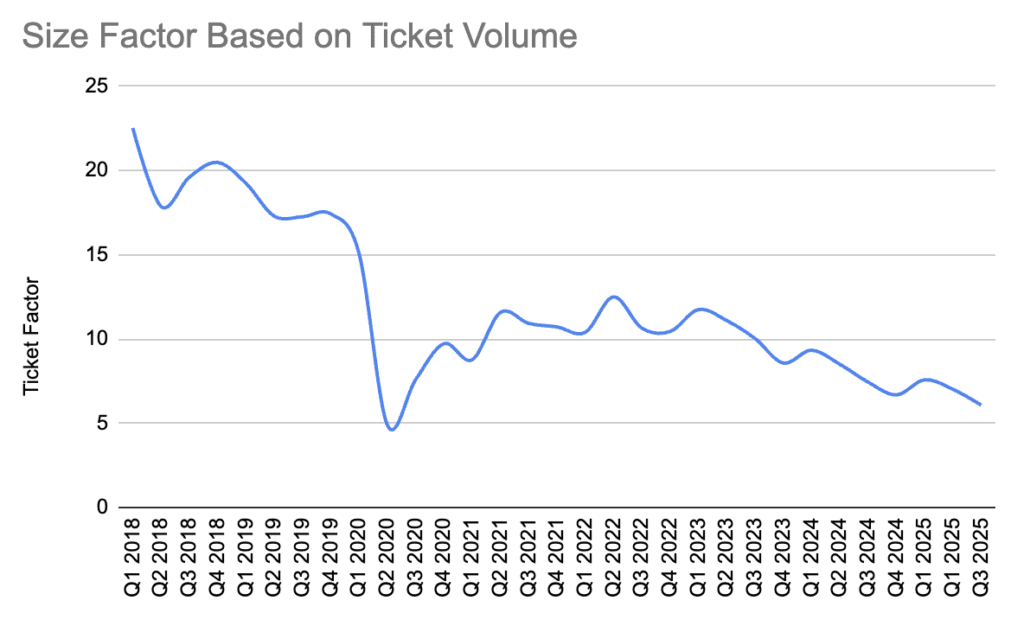

- We are a little bummed as one of our longer term goals was to grow larger than Eventbrite over the next decade or so as the graph got closer and closer to 1 (equal size), and their results will no longer be published publicly:

2. We know that this will result in unhappy Eventbrite customers, who will be looking for a new event technology provider. So this is an opportunity to help a large number of new customers. Here is a PDF of our Eventbrite to RunSignup Migration Guide.

3. This reinforces our Employee Owned company structure. It will highlight the differences between our long term approach and the financial and political approaches of Public and Private Equity owned company. Also, the low valuation will likely stall new investment in event technology. Our slow growth will be seen as being the stable technology company for events.