In many states, there are exemptions available for charging sales tax on your race registration or merchandise sales. These are most often available to non-profits or government entities. If your non-profit is eligible to claim an exemption from sales tax on selling taxable items, you can do this in the Sales Tax settings in your dashboard.

If you’re a non-profit and believe you should have an exempt tax status, there are several steps your must take in order to claim that tax exemption status.

Steps to Enable Tax Exemption Status

Step 1: Navigate to your RunSignup Dashboard. Click on Financial > Sales Tax > Sales Tax Setup

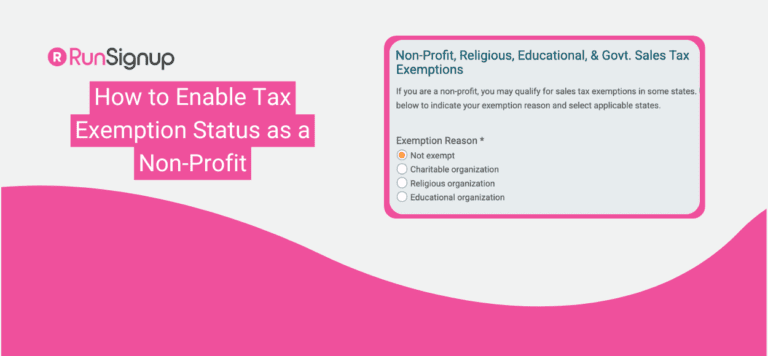

Step 2: Select the appropriate exemption

Step 3: Toggle Yes (Enable Exemption) for the appropriate state(s)

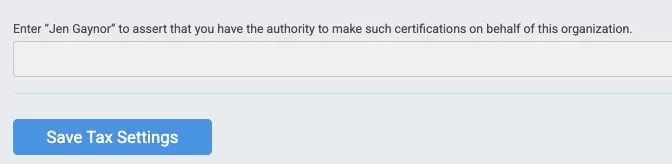

Step 4: Sign your name at the bottom of the page indicating you are authorized to make such certifications on behalf of the organization and click Save Tax Settings to complete the form.

After the form is signed, sales tax will no longer be applied to tax exempt items, in accordance with the exemption details for the state(s) where the exemption has been turned on. RunSignup will calculate, collect, and distribute sales tax on all taxable items based on whether the state is classified as a Marketplace State or Non-Marketplace State.

Step 5: If you need to change taxable item codes navigate to your RunSignup Dashboard. Click on Financial > Sales Tax > Taxable Items

Please note: this will only enable sales tax exemption for that specific race. If you have multiple races and/or events, you must also enable sales tax exemptions – if available – for the other races in their respective states. If the exemption toggle is not available for a state, it means the state does not allow seller exemptions for nonprofits.

RunSignup has researched each state to provide the applicable sellers exemption for each state. The state law is cited in the dashboard, and you are responsible and liable for complying with that law.

Sellers vs Buyers Exemption for Non-Profits

I have a nonprofit, why am I charging sales tax? There are two types of exemptions. The first is “buyers exemption” which exempts you from paying sales tax on purchases. That is not the same thing as a “sellers” exemption. If you list a race on RunSignup you are a seller, not a buyer. Typically as a seller there are no sales tax exemptions for nonprofits. However, some but not all states will exempt sales tax on items that you sell on RunSignup including registrations to your event and even merchandise (depending on each state’s rules). You can view our sales taxability matrix here to determine if your state exempts sales tax as a seller for nonprofits.

Still have questions on how to enable tax exemption status? Reach out to your RunSignup account manager or email info@runsignup.com.