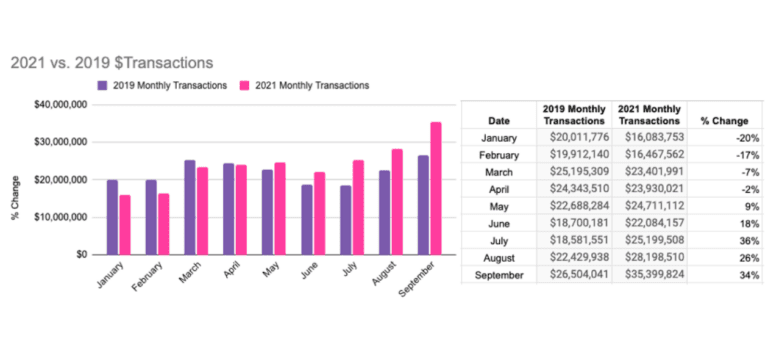

While Q2 was about returning to 2019 levels, Q3 saw us return to growth mode with transaction volume increasing 32% over Q3 2019.

In 2021 we are comparing our numbers to 2019 – the last year of normalcy. The quick way to see how our community has recovered is to compare the total transaction volume processed on our platform. The fact that the pink is above the purple by a growing margin is good news. Our customers raised 34% more in September of 2021 than they did in 2019 on our platform in spite of only partial recovery of live events.

While the transaction volume has grown, some of this is from our GiveSignup efforts with nonprofits. We are seeing a number of nonprofits holding free events that are fundraisers or focus on donations. We are also benefiting from early adopters of our purpose built nonprofit ticket platform.

We are experiencing growth in our endurance customer base, with new endurance customers representing about 15% of the registration volume.

We also track churn – the number of races that happened in 2019 that did not happen 2021 by month. In September, this fell to a post-pandemic record of only 13% of races were not held in 2021. This aligns with the growth of market share we reported on in our Q3 Registration Market Analysis.

Our strategy of building a set of purpose built solutions to enable nonprofits to engage their supporters beyond run/walk/ride seems to be gaining market acceptance. Many of our nonprofit customers are expanding their use of RunSignup into GiveSignup features such a tickets for golf outings and galas and festivals, as well as increasingly using our platform to drive donations.

We are also seeing continued strong growth in the number of events created and renewed, which bodes well for 2022.

Endurance News – Cross Country

Our company was started by cross country runners. And this is our time of year – the fall, when leaves are golden and the trails are filled with high school and college cross country runners. Our scoring software – RaceDay Scoring and The Race Director – are the leading tools for scoring these races. We did a bunch of development work earlier this year to make sure we have the best solution for these races (even though we do not really make any money at it). Timers used our software in 171 races the past 7 days specifically for cross country (492 races total).

In fact, our work on scoring software is also helping us gain market share with timers as well. Here are the stats compared with 2019 showing more races are timed with our RaceDay technology than in 2019:

Free Email and Free Websites

One of our most strategic initiatives is a next generation email system that will be available for Ticket events, Donations and Fundraising websites as well as provide a new alternative to our traditional email capabilities in Registration websites. We are also building out new Website Builder currently available for Ticket events, Donations and Fundraising websites. In the next month we will be releasing page and menu capabilities. After that we will begin to move the functionality over to the registration platform.

This means that in the Q1 timeframe, we will be offering all of our customers modern email and website functionality that they typically pay $Thousands for each year for free. Our customers will be able to raise more and spend less – enabling them to better fulfill their missions. We expect that we will attract a growing number of fundraising events over the coming years with this unique business model.

Here is an example of the email editor that will debut in Q4.

Giving Tuesday

We have also enhanced our offering to better meet the needs of nonprofits looking to maximize Giving Tuesday.

Summary

We are excited to be a part of the recovery from a very difficult time for our customers. It makes us even more motivated for continuing to release great technology that can help endurance and nonprofit customers raise more.

You can review past quarterly and yearly results here: 2012, 2013, 2014, 2015, 2016, 2017, 2018, Q1-19, Q2-19, Q3-19, 2019, Q1-20, Q2-20, Q3-20, 2020 and Q1-21.